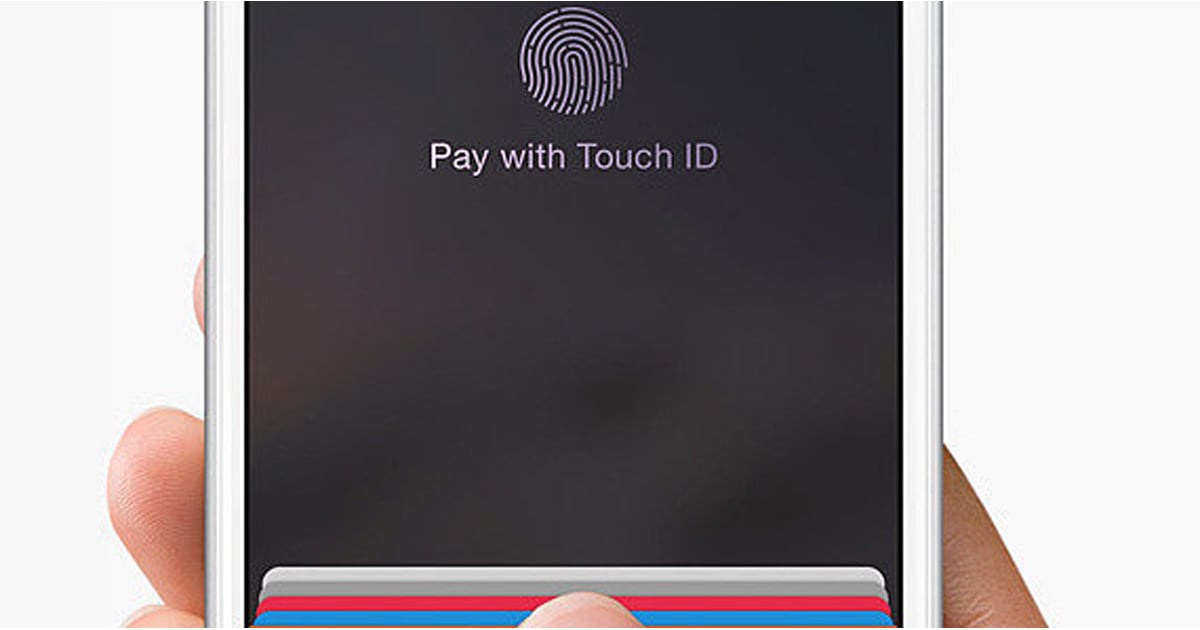

Payments must be tied to a debit card, which will be billed automatically on the payment due dates, though Apple says it will send reminders. Once approved, users can check out with Apple Pay Later and view upcoming payments in the Wallet app. The cost of the purchase, the funds available on the card used at checkout and any history with the company are often considered. Though Apple hasn’t disclosed a minimum credit score requirement, it will conduct a soft credit check as part of the application, which won’t affect your score.īNPL applications tend to be short, and providers may rely less on credit scores to qualify applicants compared to traditional credit.

Available loan amounts range from $50 to $1,000. Users can apply for Apple Pay Later in the Apple Wallet.

#Apple pay later how to#

Klarna, Afterpay and Zip all charge fees for late payments.Īpple Pay Later can be used at any merchant that accepts Apple Pay online and in-app.ĭon’t miss: Apple buying Disney? Analyst explains why they’re ‘worth more together’ How to get Apple Pay Later But Apple Pay Later sets itself apart in its combination of zero interest and no fees, which is hard to find among other BNPL providers. This pay-in-four loan structure is common with BNPL. The next three installments - each $125 - are due every two weeks. How does Apple Pay Later work?Īpple Pay Later divides your purchase into four equal installments, each due two weeks apart, with the first payment due immediately.įor example, if you want to make a $500 purchase with Apple Pay Later, you’ll pay $125 at checkout. Read: More Americans are using ‘buy now, pay later’ services to pay for groceries. “Many people are looking for flexible payment options, which is why we’re excited to provide our users with Apple Pay Later.” “There’s no one-size-fits-all approach when it comes to how people manage their finances,” said Jennifer Bailey, vice president of Apple Pay and Apple Wallet, in a company press release. Its official release marks the tech giant’s entry into the lucrative “ buy now, pay later” industry, which has skyrocketed since the start of the pandemic. THE LENDER MAY BE SUBJECT TO FEDERAL LENDING LAWS.Apple Pay Later was first announced during the company’s Worldwide Developers Conference in June 2022, but it faced delays in the fall. THE LENDER MAY NOT BE SUBJECT TO ALL VERMONT LENDING LAWS. INFORMATION RECEIVED WILL BE SHARED WITH ONE OR MORE THIRD PARTIES IN CONNECTION WITH YOUR LOAN INQUIRY. VT residents: THIS IS A LOAN SOLICITATION ONLY. Missed payments may have an impact on your credit score.

Pay Monthly is currently not available to residents of AK, CO, HI, MA, NV, NY, or TX. Offer availability depends on the merchant and may not be available for subscriptions or recurring payments. Payments may change based on shipping, taxes, updates to your purchase, or missed payments. For example, a $600 purchase can be paid at 18% APR in 6 monthly payments ($105.34/mo. 9.99-29.99% APR based on the customer’s creditworthiness. Pay Monthly is subject to consumer credit approval.

0 kommentar(er)

0 kommentar(er)